New Year, New Order: Getting Your Important Things in Order for 2026

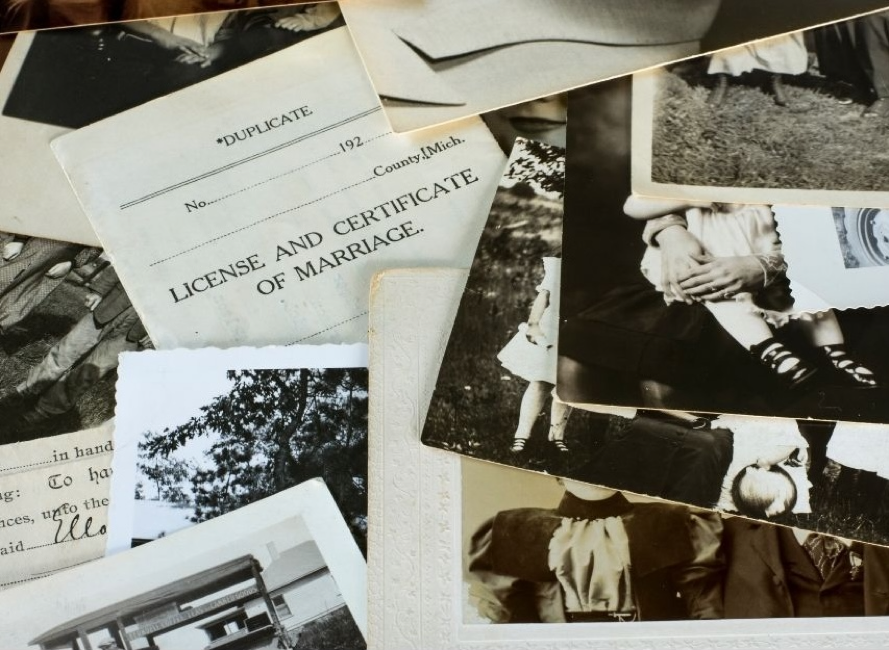

A new year always feels like a fresh start – a time for new goals, new habits, and, of course, a bit of life admin. Maybe you’ve already started clearing out closets, tidying up drawers, or finally tackling that stack of old paperwork you’ve been meaning to sort through.

The Clean-Up Squad: Because Some Things Are Better Left Managed

We all have those things – tucked away on a hard drive, buried in a drawer, or hidden in a box – that we’d prefer not to be “discovered” unexpectedly. Maybe it’s a folder of private photos, a stash of just-in-case cash, a journal filled with thoughts that were never meant to be shared or even that browser history that tells a story best left untold.

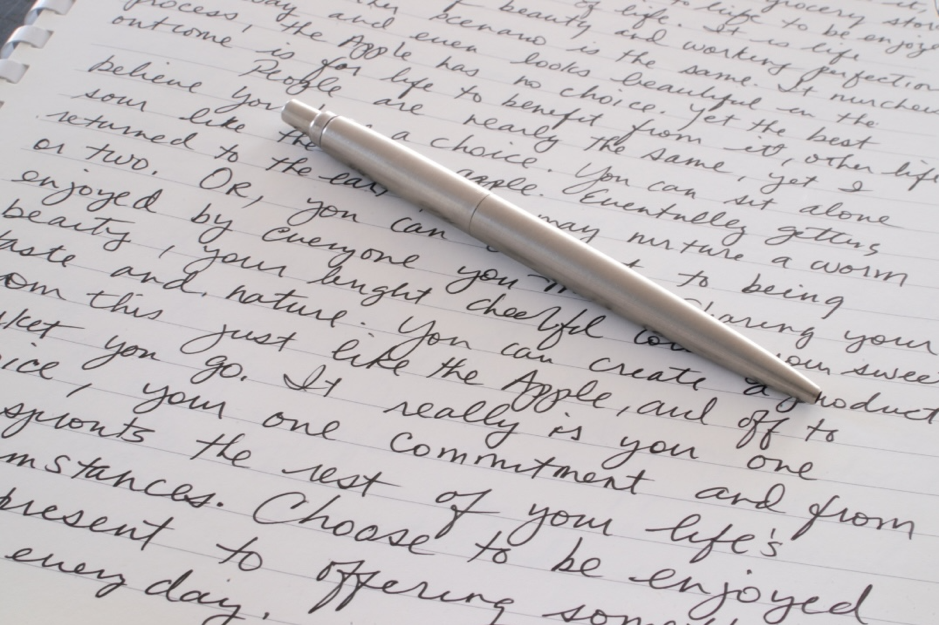

Words That Last: The Power of Personal Messages in Legacy Planning

When people think about legacy, they often focus on wills, assets, and paperwork. But legacy is about more than documents – it’s about connection. It’s about what we leave behind in the hearts of the people we love. Personal messages, notes, or letters can play a quiet yet profound role in legacy and estate planning. […]

Making Sense of Your Monthly Financial Commitments

We’re all juggling payments – from mortgage instalments and loans to electricity bills and streaming services. Most of us manage them without thinking twice, but what happens if you’re suddenly not able to stay on top of it?

It’s not only about the long term – life can throw curveballs. An accident, illness, or even a period where you’re unable to communicate can leave others trying to untangle your financial commitments. That’s where planning ahead makes all the difference.

More Than Priceless: Documenting Your Art & Collectibles the Right Way

Art and collectibles aren’t just “things.” They can be part of your story, your taste, and your legacy. But they’re also assets – and without proper documentation, their true worth (financial or otherwise) can easily be overlooked.

Signals, Not Noise: How Financial Institutions Can Empower Meaningful Legacy Planning

In an era where information overload is the norm, financial institutions play a critical role in helping clients filter out the noise and focus on what truly matters—particularly when it comes to legacy planning. When clients are faced with the task of planning for their future and securing their family’s well-being, clarity and organisation are key. By streamlining client information, improving communication, and reducing the friction of legacy administration, financial institutions can turn a complex and often overwhelming process into a seamless experience.

Cut Through the Noise: How to Make Sure Your Final Wishes Are Understood

In a world flooded with constant information, ensuring that your final wishes are understood and easily accessible becomes a crucial responsibility. It’s easy to get lost in the noise – our busy lives, digital clutter, and emotional overwhelm. But when it comes to your legacy, clarity is key. Without proper documentation and clear communication, your loved ones may face unnecessary confusion and stress during an already difficult time.

The Things Clients Forget—and Why It’s Your Responsibility to Help Them Remember

As a business or financial services provider, it’s your duty to provide value beyond the basics. Clients trust you to help safeguard their financial futures, which includes managing not only the obvious aspects of their wealth but also the finer details that are often forgotten.

When clients forget important information – such as updating beneficiary records, reviewing employee benefits, or ensuring pension information is correctly logged – it creates unnecessary risks for everyone involved.

The Things We Forget: How Life Admin Gaps Can Burden the People We Love

In the hustle and bustle of daily life, it’s easy to forget the small but important details that can have a big impact later. From personal finances to legal matters, we all have those tasks that we put off—thinking we’ll get to them “someday.” But what happens when that “someday” never arrives? Unfortunately, those unaddressed gaps can place an unnecessary burden on the ones we leave behind, causing stress, confusion, and complications during what is already a challenging time.

Will Your Clients’ Loved Ones Find What They Need? Rethinking Legacy Accessibility in Financial Services

In today’s fast-paced world, clients trust financial institutions, insurers, and employers to safeguard their wealth, ensuring that their families are financially protected when the time comes. But, while financial security is critical, a crucial question often goes unasked: Do clients’ families know where and how to access their wealth when they need it most?